Truck Accounting Software

The advantage of using owner operator trucking accounting software is the ability to be able to undertake fleet-specific tasks including IFTA tax reporting,.

I have been using Trucknpro for several years. I have been pretty satisfied with it. I have used several other accounting programs, but Trucknpro is designed specifically for this industry and is very simple to use. If I were not using Trucknpro I might use something like Quickbooks Pro. Other than simplicity, I like that their software helps track maintenance, drivers and other things specific to trucking, such as IFTA. Unless you use a program specifically designed for trucking you will need to find other ways in which to keep track of your IFTA, maintenance, etc., Another feature I like is that the program keeps my data on MY computer rather than in some unknown cloud.

Some software has gone to renting their software with a monthly fee rather than being able to buy the program outright. With Trucknpro you pay a fee to purchase the program, download it to your computer and then never pay another fee unless you choose to buy one of their other programs. Click to expand.Most of the trucking software that I have used has limitations on the number of trucks you can use with their software. Some will allow you to pay a higher rate to enable you to add more trucks. Trucknpro Biz Manager (their newest version) will allow you to add an unlimited number of trucks and trailers. It allows you to set it up for hauling containers (if that is all you do) or cars or for LTL in addition to hauling Truckload. I am not sure Quick Books would be the best choice for those owning multiple trucks.

Some reasons for having a trucking specific software, such as Trucknpro is that we are required to have a maintenance file for our equipment. I don't know how you would set that up in Quick Books.

It is already set up with the Biz Manager program. It also has a driver qualifications file.

You can scan your driver's CDL, medical card application and any other information on each driver and put it in an electronic file. With this software, you will assign each load to a specific driver. If anything comes up with the load, you can easily look it up.

The software enables you to print up a number of reports. Another feature I like if you have drivers is that you can set it up to calculate their gross pay by mileage, percentage, hourly or hundredweight. That flexibility makes it easy to calculate detention. It doesn't calculate the taxes for payroll, but that is fairly easy to calculate or you could set up that part of your payroll in a spreadsheet.

That is what I did at one time. I had a spreadsheet set up for each driver. Once you set up the rates, it is easy to do your payroll.

Independent Truck Driver Accounting Software

You transfer the deductions into the Trucknpro software. If you have hundreds or thousands of drivers, this might not work as well for you. But, it is an inexpensive way for a smaller carrier, fleet owner or independent to keep their accounting current. You can print out a settlement sheet for each driver by the load or whenever you do your payroll. The way it is set up also works very well if you have owner operators or others who work on a 1099.When I originally set up my maintenance files using the software, I set it up where I could track PM's and tires separately.

It isn't something that is necessary, but it enabled me to get a better idea of where my money was going. When you put the maintenance expenses into the program, you can assign it to a specific truck or trailer.

If it were not for the various reporting requirements we must do, Quick Books might work. But, with all the difference compliance records, I have found it to be easy to use and the program provides the information I need to run my business. IFTA is a feature that is incorporated into most of their software. You can either use it or not. If you own a fleet of trucks and are leased to another carrier, you don't necessarily need to use the IFTA feature, but it is a good way to track those costs and will help you check your carrier for those deductions.If you put the information in correctly, you can see the mpg and expenses for each driver and truck. It will show you a profit and loss on each truck or for the entire fleet.

When you put the load into the system, you start with revenue and it guides you through each of the expenses. It will carry forward the pro number for each load and once you key in your shipper or consignee, it will automatically fill in the information. It will also do the same thing with your costs. It will auto fill the mileage from the previous load and will keep deadhead miles separate from the loaded miles. In any business, reliable information is critical. You can see how much deadhead your drivers are doing and will automatically calculate your cost and profit per mile.

With this new version you don't really need any other accounting program. At one time I used an early version of Trucknpro and another program called Easy Trucking. I found that I preferred Trucknpro, mostly because of the simplicity of the program.

With this new version of the program, I don't think that I will need anything else.Specific tax issues, such as depreciation can be handled by your tax preparer or keyed into this program. I would suggest you go to their website and check out the program.

There is a training video on the program you can download. It gives a good idea of the capabilities of the software. You should be able to see if it will work in your situation. Click to expand.The Trucknpro people were talking about making changes to their program which would allow customers to export data into Quickbooks.

I know a lot of accountants use Quickbooks. I don't know if they ever worked that out.

With the reports and profit and loss you can print from the program, your accountant would have all the information he would need. I did not realize you could alter the Quickbooks program. What changes did you make with the Quickbooks program that made it work for you? I do understand what you are saying about not being able to find exactly what you want in trucking software. Other than this new Trucknpro program, the only other trucking program that I found that would provide me what I needed was Truckers Helper. But, I would have to purchase their largest program to get what I wanted and it was a little more complex to use.

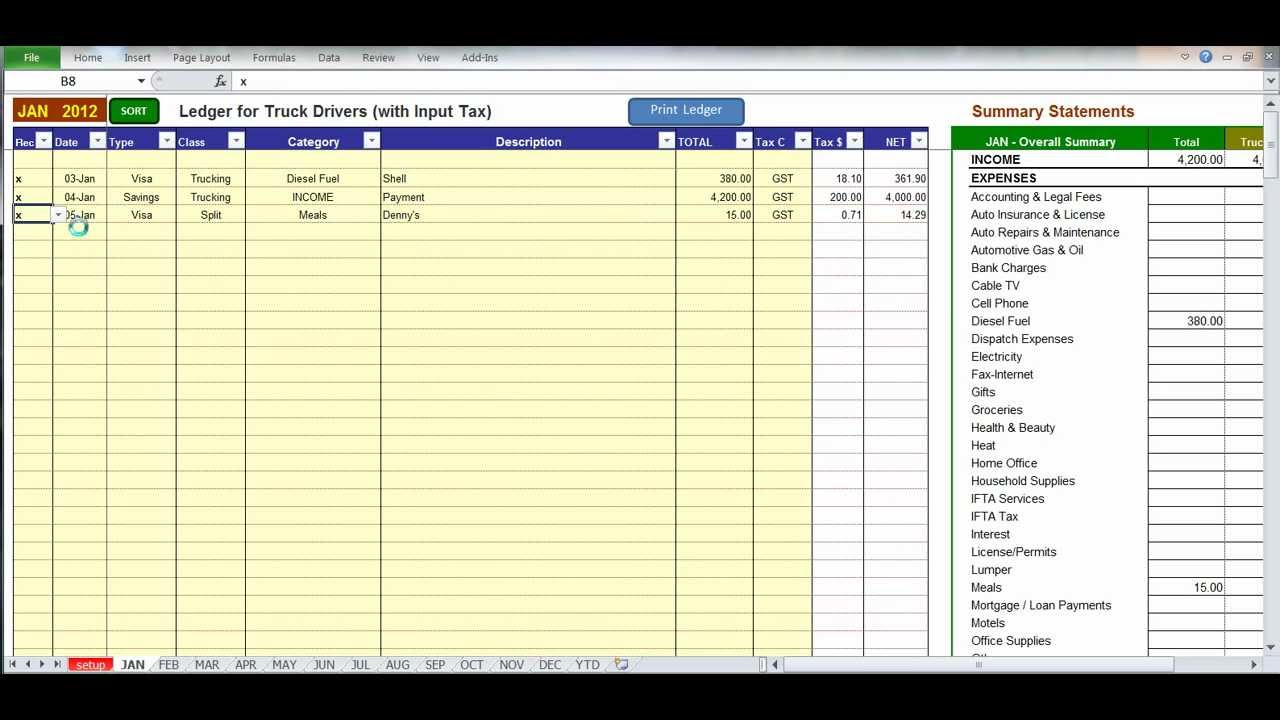

Operating a small to medium size trucking company can be time consuming. Invoicing your clients, paying the contractors, paying the drivers, accounting for miles and fuel purchases and managing repairs are just a few of the weekly tasks truck owners are faced with week in and week out. Unless your office is fully staffed, you need to automate these tasks using TruckBooks trucking software. To stay on top you need to make wise use of your downtime. Why not enter your daily trip data in a user friendly interface that allows you stay up to date with clients, owners, drivers and other business accounting activity.

You can always hire someone and pay through the nose for services like estimated taxes, client invoicing, IFTA/ road tax reports, year end income reports while keeping adequate fleet maintenance records. No one knows your business like you do and if you are an active owner using your time wisely, you can benefit more than you can imagine.

TruckBooks allows you to stay up to date with every aspect of your trucking business. Regardless of whether you’re a fleet driver hoping to keep tabs on your miles and reimbursements, or a trucking company owner who needs to manage the entire business- there is now a software application for you.

There are two sides to TruckBooks, first there is an Over the Road module but there is also, dump truck accounting software, included in the same module. You can never tell how your business will grow. Allows you to bulk invoice loads hauled by weight, load or by the ton. You can handle large road or construction jobs and pay contractors keeping all your ducks in a row. You call also Invoice the client, pay the contractor or truck driver, all in one click.If you are looking for cloud-based software for a dump truck hauling business with 10 or more trucks, you should look at our other program.

Bulk InvoicingHaving multiple jobs with multiple clients along with multiple products hauled can be a hassle for a trucking company or accounting firm.Having the right software for the job can bring some order and accuracy back to the office and improve your professionalism among competitors. Clien t Database ModuleNever lose track of another client or their credit information Over the Road ModuleThe OTR module is designed especially for the over the road trucker -tracking loads, fuel,and mileage data. Dispatch ModuleThe Dispatch Module allows for easy texting to drivers with load information, directions and company instructions. Fuel Miles ModuleTrack your fuel and miles and produce an automated fuel tax report for IFTA purposes T ruck Repair ModuleTrack repairs on the job or over the road and know what your expenses are on each unit. Profit & Loss StatementOne click profit & loss statement allows you to see if your latest venture was a profitable one.

Dr i ver Payroll ModuleThe Payroll module allows you to enter driver's data, track taxes withheld and print a pay stub Truck Maintenance ModuleTrack all Real time and preventive fleet maintenance activity with a proactive maintenance and corrective action plan module IFTA Quarterly Tax ReportYour IFTA tax report is an automated feature as you enter your daily load activity, making filing your quarterly IFTA report quick and easy.